African Bank of Oman

About African Bank of Oman

African Bank of Oman is a Corporate Investment Bank specializing in transaction banking and trade finance, with a focus on supporting large corporates engaged in trade between Angola, the GCC, and surrounding regions.

CEO Message

At African Bank of Oman, we are driven by a bold vision — to help shape the next chapter of Angola’s economic story and strengthen the bridge between Africa and the Middle East. Our purpose is rooted in progress: to empower businesses, unlock opportunity, and contribute to a more connected and prosperous future for our clients, our communities, and our nations.

Our Mission

Empower growth by building meaningful partnerships and creating pathways to opportunity, delivering trusted financial solutions that simplify life, inspire confidence, and help clients thrive.

Our Vision

To redefine banking by delivering seamless, innovative, and exceptional customer experiences that inspire confidence and growth.

Our Values

Customer Centricity

Driven by Innovation

Integrity

Excellence

Simplicity

Governance

At the core of our corporate governance framework are principles that guide every decision and action we take. We are committed to:

Institutional Soundness and Stability

Transparency and Accountability

Operating with openness and responsibility, fostering trust through clear communication and ethical practices.

Effective Risk Management

Regulatory Compliance

Ethics and Integrity

Conducting business with honesty, fairness, and respect, reinforcing our commitment to ethical behavior in every aspect of our operations.

Corporate Clients

Accounts

Financing Solutions

Trade Finance

Services

Accounts

Financing Solutions

Term Deposits

Services

Others

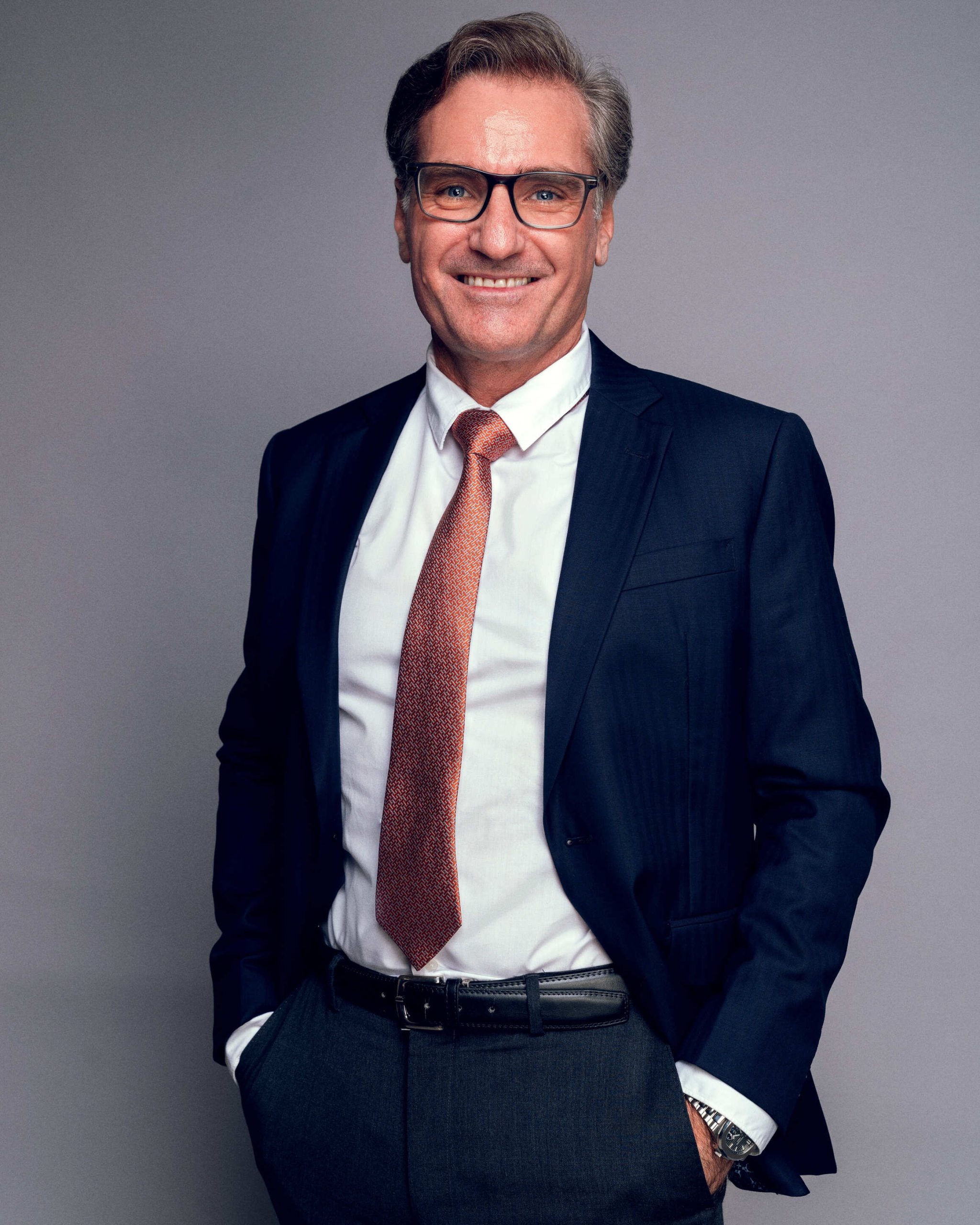

BOARD OF DIRECTORS

Meet the dedicated team of experts,

committed to serving with trust and excellence

Latest News

Stay updated with the latest insights, announcements, and developments from the African Bank of Oman.

Discover how our initiatives, partnerships, and financial innovations are shaping the future of corporate banking across the GCC and Africa.